Futures

Introduction

Futures contracts are financial derivatives which are agreements to buy or sell a given quantity of the underlying assets at a predetermined price on a specified date in the future. Underlying assets can be stock, market index, currency or commodity.

Investors can trade futures on the HKEx. Investors can buy or sell them with a margin deposit, which only partly covers the value of the contract. Going into leverage can increase the size of investors’ gain or loss. Trading futures can be risky as a broker can make a margin call. This means Investors must put in more cash or securities to cover the shortfall of investors’ margin deposit in case the price of the underlying asset moves against investors’ view. The loss could be much more than investors’ margin deposit.

Remember though that not all futures contracts are linked to a product that can be physically delivered. A stock index futures contract, for example, is generally settled for cash.

Clients can trade Futures from seven major futures markets in the world through Kingfield Trading Securities Futures (HK) Limited. The trading hours cover 24 hours and cover more than 70 futures commodities.

Why Trade Futures with Kingfield Trading

Securities Futures (HK) Limited?

Products Cover the Globe

Our products cover major global futures exchanges, including: HKIF Hong Kong Futures Exchange, LME London Metal Exchange, CBOT Chicago Mercantile Exchange, CME Chicago Mercantile Exchange, COMEX New York Metal Exchange, NYMEX New York Mercantile Exchange and SGX Singapore Exchange.

Product Diversity

Kingfield Trading Securities Futures (HK) Limited provides investors with a variety of futures trading products, including: stock futures, metal futures, foreign exchange futures, index futures, energy futures ant agricultural futures, to meet the needs and investment orientation of different investors.

Simple and Flexible Trading

All futures products can be traded on our powerful online trading platform. Funds in securities account and futures account can be transferred to each other. And as long as there are funds in the futures account, no matter what currency, investors can use to buy or sell out any products. After the transaction is completed, investors can contact the company to carry out the exchange operation.

Features of Futures:

- Margin Trading

Futures contracts use margin trading, and leverage allows investors to get greater potential returns.

- Settlement of Futures

Futures products can be divided into physical delivery or cash settlement. However, please note that some physical delivery products will be forced to close position before last trading day. Please contact us for details.

- The Expiration Date of the Futures

Futures contracts have established last trading days, notice days and settlement dates, and will be suspended after expiration.

- Directional Trading

Investors can achieve "short selling" transactions and make profit in bear market through Futures products.

- 24 Hours Trading

Seven major futures markets cover the globe, allowing Investors to seize investment opportunities 24 hours a day.

- Implement Different Trading Strategies

Futures are not only a single investment product, but also a flexible investment instrument with investors’ original assets portfolio to achieve different trading strategies such as speculative, hedging or arbitrage.

Why Do Investors Trade Futures?

In general, there are three main reasons for trading futures: directional trading, hedging and arbitrage.

Directional Trading

If investors expect the stock market to rally, investors can opt for directional trading by buying a stock index futures contract. Investors make a profit if the final settlement price is higher than the contracted price when investors bought the futures contract. On any day on or before the last trading day, if the going price of the futures is more than the contracted price, investors can realise profit by selling the same futures contract to offset original long position. On the other hand, if investors think the market will fall, investors can sell a stock index futures contract to gain profit from it.

Hedging

Hedging strategies are commonly used to offset any negative effects on an investor's portfolio return. If investors want to mitigate the loss in a falling market, then investors can use a short hedge by shorting a stock futures contract.

If investors are trading in futures, investors must remember to pick futures contracts in which the underlying assets correspond to the holdings. For example, HSI futures are not the ideal tool to hedge red chips which are not HSI constituent stocks.

Arbitrage

Arbitrage allows investors to earn profits by capitalising on unusual price discrepancies between the futures market and the underlying cash market.

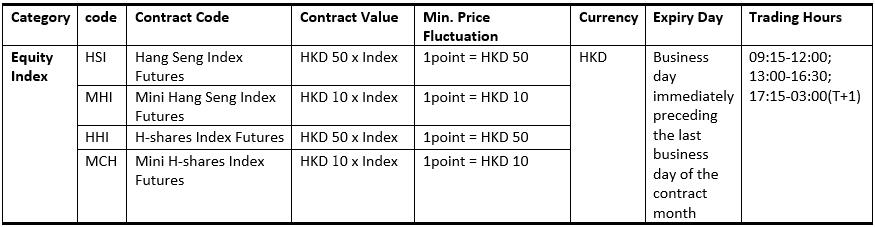

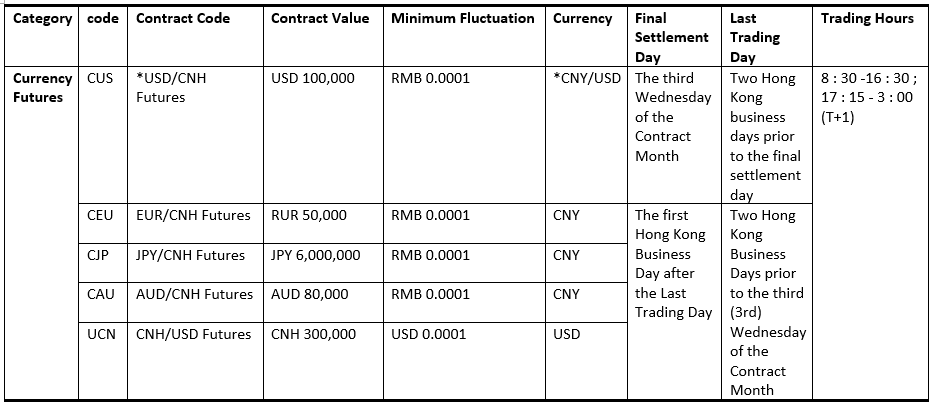

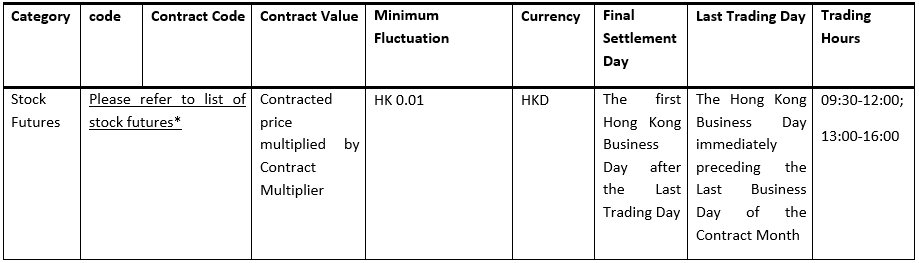

Contract Specifications

Hong Kong Futures:

Note: * USD/CNH Futures physical delivery: Delivery of US dollars by the seller and payment of the final settlement value in RMB by the buyer.

Note: * Stock futures contracts are settled in cash. There is no physical delivery of underlying stocks on the final settlement day.

* The Margin requirement will be updated from time to time. Our company will make adjustments according to HKEX. Please refer to the HKEx website: http://www.hkex.com.hk/eng/market/rm/rm_dcrm/riskdata/margin_hkcc/HKCC_Margin_Levels_eng.xlsx

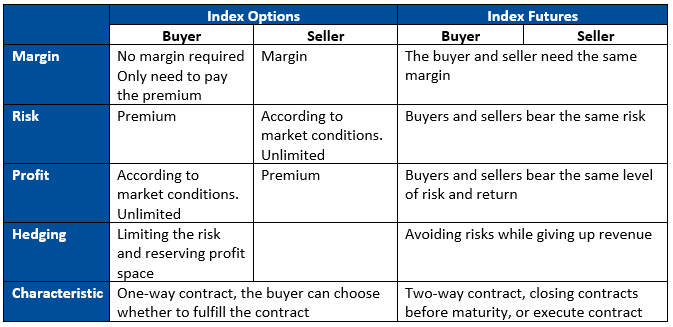

Index Options

Index options are generated on the basis of Index Futures. The option buyer pays the option seller an option premium to obtain the right to buy or sell the index contract at a certain price at some time in the future or before that time.

We provide customers with HKIF Hong Kong Futures Exchange Hang Seng Index Options, Mini Hang Seng Index Options, H-shares index Futures Options, Mini H-shares index Futures Options and USD/CNH Options.

The Difference Between Index Futures and Index Options